What drives Price?

I thought it would be helpful to outline what can drive the price of a token and more importantly why it's important to take a long term view on projects with real utility.

I am not a financial advisor, but here are some things to consider about what can effect the price of a cryptocurrency, and ultimately drive movements of price in any crypto.

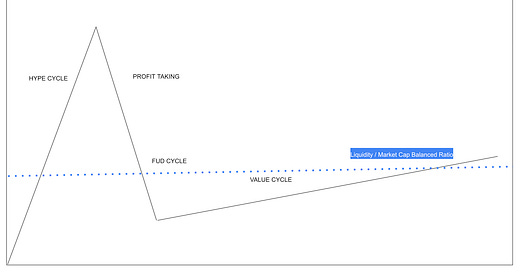

The first thing to acknowledge is the patterns of all cryptocurrencies when they launch. ⚠️ No token has ever avoided the basic pattern below ⚠️.

Of course, some may never cross the chasm into bringing real value into the market, but all of them have to go through the 4 stages of a crypto asset.

Four Cycles of Crypto

⭐ STAGE 1: Hype Cycle 🟩 🟩 🟩 - This is the launch where the concentration of marketing dollars and excitement creates an over-valued token price.

⭐ STAGE 2: Profit Taking 🟥 🟥 🟥 - This is where early buyers begin to sell-off a majority of their position.

⭐ STAGE 3: FUD Cycle 🟥 🟥 - This is where all buyers begin to question the project and its long term viability and begin to sell off a portion of their holdings.

⭐ STAGE 4: VALUE Cycle 🟩 🟩 🟩 🟩 🟩 🟩 🟩 🟩 🟩- This is where the actual utility and adoption of the token begins to take hold and creates an inflow of buying through organic “use” of the token. The good news is this is where stability sets in - the bad news is it can take years for a project to reach this cycle.

Every token follows this pattern, and the height of the hype cycle depends on the marketing budget and the tokenomics to some degree. The Profit Taking always consolidates from 5x to 10x returns. This is the psychological limit of the average crypto buyer. The minute they see 5x+ returns they will begin to sell. This is why this pattern is unavoidable. It doesn’t matter how good the idea is or how many buyers they continue to bring into the project - the price rising at a rapid rate means new buyers are paying too much, and early sellers will bring the price down rapidly.

Other Factors

Outside of the pressures of the hype cycle and profit taking, the other factors that drive price volatility include:

The size of the liquidity pool and whether it’s paired with a stable coin or other crypto asset that can also strengthen/weaken when crypto cycles happen.

The restrictions on early buyers (pre-launch)

The confidence in the team and the project overall. The FUD cycle will worsen if communication is lackluster or the project itself doesn’t show progress.

The growth and use of the utility.

Good Projects take Time

The bottom line is good project take time. Launching a utility token early has its benefits and its challenges. Being first allows you to control the brand and be the leader by default. It also means you are going to have a long cycle of FUD where holders are impatient with how long it takes to build the utility and hit the Value Stage.

Here is a great example:

Example: SAND

Here is SAND (one of the first cryptos launched for utility in metaverse). They were early to launch.

This is the chart of SAND from May to October. The first two months it went from .70 to .18 cents. Then it went thru a few more cycles of +40% and -40%.

of course, fast forward to today… and the chart above is simply a flat line (see the yellow box below). And today SAND is over $5. Why? Because around November the utility of the token started to have value.

I am not saying every token performs in the same way, but it shows how a token goes through the four stages and how it takes time for both the project to grow and the market to adopt it as a utility.

Here is another example of a strong Utility Token - MATIC (Polygon). You can see the profit taking stage from Jun thru August driving price from 2.50 to .70. And then the utility phase kicks in over the next 6 months due to the need for Level 2 on Ethereum blockchain.

Hold vs Sell

The bottom line is the price of every token is at the mercy of the market. The first 6 months are the hardest, because there will always be more sellers than holders - in both the Profit Taking cycle and the FUD cycle. When price shoots up, people sell and when price shoots down, people sell. It’s the nature of anything that compresses massive increase or decrease in value in a short period of time. It’s what has created the culture of crypto, and there is no way to avoid it. Like a storm, you have to sail through it to read your final destination.

Why Price doesn’t Matter (in early days)

I realize most people will think this statement is absolutely crazy, but I would argue there is a mountain of evidence that proves otherwise. In fact, it has become the primary reason so many people buy crypto. Did the price of Bitcoin matter in 2013? No. People who bought Bitcoin and held - held because they believed in its utility. If they were simply in it for profits, they would have sold 10 times from 2013 to now. When you are early in any project that has real utility, and you hold for long period of time - you will have a much higher win rate in crypto.

Price doesn’t reflect the true value of a project until it reaches the Value Cycle. Everything before that doesn’t matter.

None of this if financial advice, just observations from behind the scenes.